Update: See this post for details on a direct link to offer.

About 3 weeks ago I published a short post advising that if you were going to apply for the Bank of America Alaska Airlines Visa card with a 25,000 mile signup bonus, you should also be getting a $100 statement credit as well. Unfortunately, the link I included in that post does not work anymore for the $100 statement credit (Points With a Crew also posted about this) but there is a new way I just discovered to still get the Alaska Airlines Visa with a $100 statement credit.

I am about to apply for several cards and I wanted to add on a couple of Alaska cards to my list of applications (remember it is possible to get 2 (or more) of these cards at the same time). Since the $100 statement credit was meant for people who actually booked paid Alaska Airlines ticket, I tried my luck pretending to book a paid flight on alaskaair.com and it worked – the best part was I didn’t actually have to purchase the ticket – it appeared on the final payment page and the language seemed to indicate to apply for the card BEFORE buying the ticket so I could then use it to buy that ticket if I so wanted to. Take a look at the offer:

Here are the exact steps I took:- Searched for a random flight only on Alaska Airlines metal

- I did NOT log in and chose to checkout as a guest

- Filled out passenger information but left frequent flyer number blank (probably doesn’t matter if blank or not but that’s what I did)

- Skipped through to final payments page and clicked the “Apply Now” button as seen in the above screenshot. IMPORTANT: My mouse didn’t change icons indicating it was a clickable link – however if you click the words “Apply Now” (or anywhere in that little box), it will take you to a Bank of America page that looks like one below.

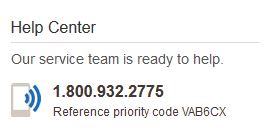

Unfortunately there is no direct link I can link to that will take you directly to the application – you must come from the Alaska Airlines website to access the offer. If for any reason you can’t get the landing page to appear, you can also call to apply and tell the representative you have a reference code which is VAB6CX. I saw this as I was applying online.

With every application, Bank of America is essentially paying you $25 ($100 statement credit – $75 annual fee) to earn 25,000 Alaska miles. If you were able to get 3 of these cards in a day (Frequent Miler was able to get 4 BofA Virgin Atlantic cards in a day), that one credit pull would be worth 75,000 miles in addition to receiving $75 dollars. That sure beats paying $225 for the same amount of miles if you didn’t know about this new little hack. So back to the initial point from my prior post on this subject – make sure you get a $100 statement credit whenever applying for a Bank of America Alaska Airlines personal card.