Update Dec. 2015: Per the comments, the double application trick is effectively dead.

Note: I posted an update here about the miles posting.

Back when I first got into points & miles, one of first tricks I learned from other blogs was the infamous “two browser trick” with Citibank American Airlines credit cards in which you could get two American Airlines credit cards with a 75,000 mile signup bonus if you applied for the cards at the same time using different internet browsers. Well, I can now confirm the newest two browser trick: Alaska Airlines personal credit cards from Bank of America.

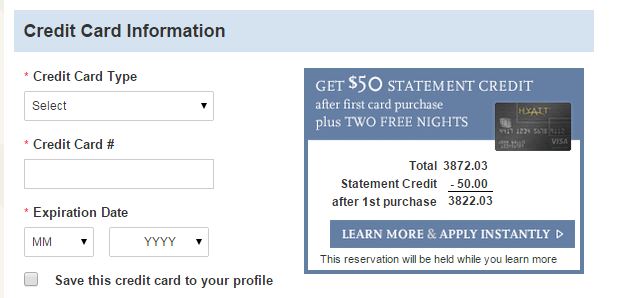

While prepping for my wife’s latest round of credit card applications, I wanted to include an Alaska Airlines credit card since they are churnable as you can get the signup bonus again and again without any issue. On Flyertalk, there was a post of someone getting approved for both cards at once so I decided to try it and report my findings. The current best offer for the Alaska Airlines credit card is 25,000 miles + $100 statement credit after spending $1,000 in 3 months with the annual fee of $75 NOT waived. This isn’t the largest ever signup bonus for this card and not necessarily an exciting offer by itself. However if you could double this offer for a single credit inquiry, this offer becomes more attractive.

Here how I got approved for two personal Alaska Airlines credit cards:

- Closed all internet browsers and opened an incognito Google Chrome window and a private session Internet Explorer (I’m sure a private window in Firefox would work as well).

- Pasted the link for the 25,000 mile offer + $100 statement credit in each browser.

- Important: On one application, I chose the Northern Lights design while on the other I chose the Classic design. I have no idea if this actually made a difference but my thinking is BofA’s computers will not mark the applications are duplicates since technically the applications are different due to the card design. I haven’t tested trying out the same design on each but I recommend doing different designs since I know this works.

- I completed the application for my wife in each window quickly to avoid possible timing out the page but I did NOT click submit yet.

- Once I got to the next page before hitting the final submit application, I quickly verified the information I entered on each was identical (with the exception of the design of the card noted above).

- I clicked submit on one application and I immediately, as quick as I could (use ALT+TAB) switched to the other application and hit submit. I did this in about a second or so. I don’t know how quick you need to be but I imagine a few seconds is fine.

- About 30 seconds later, I got the message my wife was instantly approved for both cards with identical credit lines on each card. Make sure the credit line is above $5k otherwise you will get approved for a lower level card and not receive the 25k miles.

- Since there is no minimum spending requirement for the 25,000 miles (you only need to spend the $1,000 to get a $100 statement credit), the miles should have posted a few days after approval. I applied for the cards on 1/10 and 50,000 miles posted in my wife’s account on 1/18 though the activity was backdated to 1/12. SUCCESS!

- I currently see two credit pulls from Bank of America on my wife’s credit report. They haven’t combined just yet but I fully expect them to do so within a few weeks. And if they don’t, I’m confident in my ability to call and get the pulls combined.

Will this work for other Bank of America credit cards? I don’t know and I haven’t test this out to try it. Personally, I believe the offers from BofA to be pretty weak with the Alaska Airlines card as the true standout among their offers due to how valuable their points are.

What if I’m not instantly approved and I have to call the reconsideration line? I don’t know how Bank of America will react if a rep see two pending applications. They will most likely assume it’s a duplicate application but you might be able to explain why you need two cards. You could explain that you want to track different type of expenses or if you added an authorized user on one card, you want to keep the expenses from individuals on separate statements. This is a big YMMV.

Can I do this with Bank of America Business cards? Again, I don’t know and I haven’t tested it. What is interesting though is that after applying for the personal card, on the approval screen I was offered the chance to apply for the business version of the card as well. I didn’t try it out as my wife doesn’t have a legitimate business but I did have someone else try this for me. The business application was initially marked as pending after getting approved for both personal cards. After a call to reconsideration, he was approved so in total he netted 3 Alaska cards (2 personal, 1 business) in a day.

Post your results and findings in the comments!