Note: UFB devalued this card in June 2015 and in short, it is not worth applying for.

One option many people do not think about to earn miles is using debit cards and for good reason. For starters, there is only one remaining option that new applicants can apply for so this isn’t widely known and more importantly, credit cards earn miles at higher rates and offer much greater benefits such as warranty protection and travel insurance. However, there are times where credit cards won’t help you if you can’t use them to pay certain expenses or would cost too much in processing fees to make it worthwhile to use them, so to maximize miles earned, a rewards earning debit card would help fill those gaps.

The only remaining option I am aware of for new applicants to apply for is a UFB Direct Airline Rewards Checking account which comes with a debit card that earns American Airline miles on debit card transactions. The earning ratio isn’t great – only 1 mile per $2 spent on debit card transactions. Obviously this reward program can’t compete with any credit card but this poor mileage earning ratio is better than nothing for transactions in which you can’t use a credit card and wouldn’t earn any miles anyway.

Here are the features of this account:

- 1 American Airlines mile per $2 spent on debit card transactions

- 1,000 American Airlines miles for 1st time direct deposit totaling $1,000 or more in a calendar month

- No minimum balance requirement

- No monthly maintenance fee

- Unlimited ATM reimbursements (excluding international transactions)

I applied for this card last month last month at this link here and learned a few interesting things along the way. The application process itself was pretty standard with the usual information requested – nothing unusual there. However, I did learn the following:

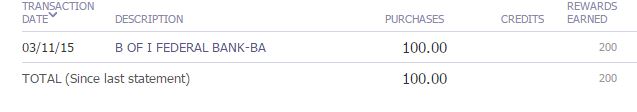

- You can fund this account with a credit card...but only up to $100 maximum :(. For the record, I used my Barclays Arrival + and was not charged any cash advance fees.

- Make sure to select checks while opening the account. If you do not request checks at this point, you have to pay for them.

- Customer service is not the best. I sent a secure message with a question and never got an answer let alone an acknowledgement of the message. I did call and get my answer but slightly annoying to have a secure message feature that doesn’t work.

- Their website is from the Y2K generation. It’s old, outdated but functional I guess.

- Lastly, a rep will call you a few days after you open the account to see how everything is going. I don’t understand the purpose of this call as I didn’t even receive my card or checks in the mail yet but I said I was excited to start using this account.

I received my card a few days after that and I began using it to fill in areas where I couldn’t use a credit card, such as paying bills like my mortgage and car loan with Evolve Money. Evolve charges a 3% fee on all credit cards but didn’t on debit cards. This worked well until Evolve closed this loophole and instituted a 3% fee on UFB debit cards.

While a loss, there are still some exciting ways to earn miles with this card. One way would be if you have tax payments to make – using a credit card costs 1.87% of the taxes bill in fees while a debit card has a flat fee of usually $3-$4. There are some manufactured spending techniques in which a debit card could come in handy which I am going to explore. In short, signing up for this card won’t earn me a ton of miles (I would probably be shut down by UFB before I get to this point) but I do like having the option to earn miles now on debit card transactions.