Last month, there was an article on Bloomberg about how the Chase Sapphire Reserve card reduced Chase’s profit by almost $300 million dollars due to the lucrative signup bonus and features on the card. While the figure seems high at first glance, it apparently wasn’t good enough. Yesterday there was an article on CNBC (h/t Chuck) about how Jamie Dimon, CEO of JPMorgan Chase, wishes the card cost Chase even more money! Jamie was quoted as saying “The card was so successful it cost us $200 million, but we expect that to have a good return on it. I wish it was a $400 million loss.”

Now Jamie, I’m sure you have a high priced team of finance guys crunching the numbers behind this card but as a finance major myself, I’d thought I’d offer some free suggestions on how you could achieve your goal. In fact, I have 24 suggestions for you, though please pay special attention to suggestion # 5/24.

- The signup bonus – a 100,000 points. Been there, seen that. Want to be remembered as a legend in the credit card space? How about a 500,000 point signup bonus – Go big or go home.

- Make the card out of an actual sapphire (metal is so 2010).

- Increase The Points Guy commission’s to $1,000 per approved applicant so he afford another website redesign.

- Or so he can hire more staff to cover “breaking news”. I think he might have just posted about that JetBlue vacation deal.

- How about eliminating the 5/24 rule so everyone can get the card? I promise you will literally have thousands of people signing up the card the millisecond that rule is revoked.

- Amex has their own lounges – how about a network of Chase lounges accessible by Reserve members only?

- Might I suggest calling it the Sapphire Lounge? And no, do not call the JFK and/or LGA lounge Sapphire New York (might get a slightly different impression than intended….) Or if you want to do something with Sapphire New York, maybe offer 10x points earned on every dollar spent there?

- Stop having unattractive bloggers selling the shit of this card all day. Hire the Victoria Secret Angels and let them go to work.

- Every card doesn’t charge foreign transaction fees these days. Take the next step and pay customers to charge items in foreign currencies!

- Run a contest and see which Boarding Area blog can sell the most Sapphire Reserve cards in a single day. Winner gets a personalized Reserve card with Jamie’s face on it.

- Increase the transfer ratio for Hyatt from 1:1 to 1:3. Chase will spend 3x more on buying Hyatt points!

- Offer a get 2 cards, annual fee on 1 is free deal?

- Every card seems to offer Global Entry credit nowadays. How about adding a benefit to skip immigration/customs altogether (note you may have to consult Mr. Trump on this…)

- Pay Lucky to rename his blog “One Chase Card at a Time”.

- Don’t give out 100,000 points. How about 100,000 dollars instead?

- Did I mention revoking the 5/24 rule already? Ya know, I’m not upset about not getting the card or anything like that….

- Increase the annual travel credit to monthly. Gamechanger.

- And instead of $300, make it $10,000. Private helicopter rides to the Hampton are very expensive Mr. Dimon.

- Remove the decimal and have points be worth 15 cents instead of 1.5 cents towards travel.

- Increase the commission you pay to MMS so they can blog like they used back in 2012 (seriously this was a great blog back in the day).

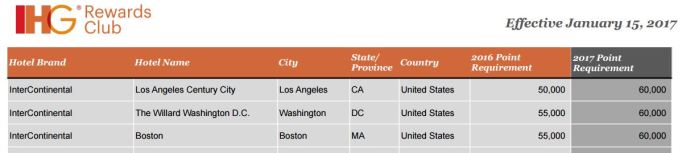

- Ditch IHG as a partner and add the Virgin Limited Edition hotels as a transfer partner. 50,000 points equals one week on Necker Island?

- Fine don’t fully revoke 5/24…just make it not applicable for this card only. Pretty please?

- 20,000 points if you add an authorized user. 30,000 points if it’s your dog.

- Lastly, don’t drop the signup bonus to 50,000 points online. Seems crazy I know but maybe keeping it at 100,000 points online will cost Chase just a bit more money like you hope. Have your finance guys double check this one.

There you go Jamie, twenty four well-thought, foolproof AND expensive suggestions to further reduce Chase’s profit. Now next time you have some big news to drop, I hope you’ll consider PointsCentric as your spokesperson instead.