Earlier this year, I detailed my experience opening a Citigold checking account to earn American Airlines miles and how I was able to fund it successfully with a credit card. Once the miles had posted for opening the Citigold account, I downgraded the account to a Basic Checking account which I have kept open with the minimum amount ($1,500) in it to avoid any monthly service fees. I realized I never opened a savings account with Citibank when I opened that checking account so last week I opened a Savings Plus account for the sole reason to fund it with a credit card to earn points. Spoiler alert – I was successful but here is a recap of the various steps I took and important details you need to know.

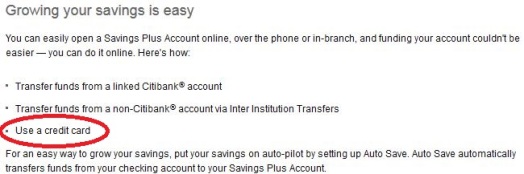

While there are various ways to apply for this account, I chose to apply online as this was the quickest and most convenient method for me. On the Citibank Savings Plus account information page, it clearly lists the ability to use a credit card to fund the account which alleviates any concern about using a credit card.

After clicking the Apply Online button, you will see a screen asking you to choose which kind of Savings Plus account package you want (Citigold, Basic etc..). Since I had a Basic checking account now, I obviously just chose the Basic Banking Package (even though it’s called a package, I was only opening a Savings account). After filling out all the required information, you will eventually get to a point where you will be asked how you want to fund your account. The following is important as only the initial funding can be done via credit card and you don’t want to mess this up!- Decline any offer to fund the account with a Citibank checking account or any other account you may have with another bank.

- Note: You actually can’t fund a Citibank account with a credit card online. Unlike when I opened my checking account, I was not given option to print a form to fax in my credit card information to fund the account so I would have to call in to fund it.

- It is advisable to wait a day to call in to fund the account as reps can’t initially process funding on the account.

- In the meantime, decide which credit card to use and set the cash advance limit to zero. Doctor of Credit maintains an excellent list of which cards will post this as a purchase vs. a cash advance. It might also be helpful to call your bank and inform them of a large purchase but I did not do this.

- I would choose either a Citibank or Barclays credit card as I haven’t read many reports of those cards posting as cash advances. I personally used my Citi Prestige. Citibank won’t accept American Express so no Amex cards will work.

- DO NOT USE a Chase card under any circumstance as this will almost always post as a cash advance.

- Once you’ve waited a day call New Accounts at 1-800-745-1534.

- Protip: They are only open Monday to Friday from 9am EST to 6pm EST.

- Tell the rep you opened a Savings Account yesterday and you would like to initially fund it with a credit card. My rep noted the funding would be processed as a purchase but did warn me some banks will still treat this as a cash advance and I would be responsible for any fees.

- After providing my card information, my rep stated the account would be funded in a few days and in the event something went wrong, I would receive an email notifying me of the issue.

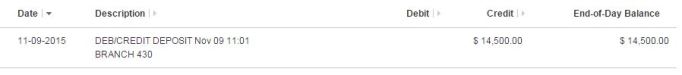

Sure enough, I checked two days later and I saw a $14,500 charge on my Citi Prestige AND $14,500 in my new Savings Account. Success!

I didn’t list it above but the only fees associated with this Savings Account is a $4.50 monthly charge if your average daily balance is less than $500. I didn’t see anything about early termination fees if you wanted to close the account right away but I personally would not do that and jeopardize your relationship with Citibank. My plan is to keep $500 in the account for a few months and close it sometime next year.

Even though I didn’t receive any signup bonus for opening this account (unlike the current Citigold offers for 50,000 ThankYou Points or 50,000 American Airlines Miles), I still think this is a worthwhile endeavor especially if you already have a checking account with Citibank from a previous offer. Opening a savings account allows you another easy opportunity to fund a bank account with a credit card for a large amount – your credit line is the only constraint! For maybe 20 minutes or so of work, I earned 14,500 Citi Thank You Points. If I redeem those points at a rate of 1.6 cents per point for AA flights, that’s worth $232 in free flights!

With how easy this is, anyone else going to try this?

Can you open a checking and savings account within a difference of few days and earn bonuses on both?

LikeLike

For the savings account, I’m not actually earning any bonus. The only thing I am gaining are points/miles by funding it with a credit card. I think you can open them several days apart and be able to successfully fund both with a credit card.

LikeLike

[…] detailed post on how PointsCentric funded a new CitiSavingsPlus account with a credit […]

LikeLike

Nice work, congrats! Reminds me of 2008-09, doing it for 7 months in a row, posting about it on FTG prior to this whole hobby blew up. Do it again next month!

Best,

PedroNY

LikeLike

Blast from the past, back when that blog was a trend setter and I actually wanted to contribute to it.

http://www.frugaltravelguy.com/2009/05/citibank-reader-success-story-read.html

Cheers,

PedroNY

LikeLike

That’s fantastic! Sad to see how far that blog has “devalued”

LikeLike

[…] My Experience Funding a New Citibank Savings Plus Account With a Credit Card – Another opportunity to fund a Citi account with a credit card. […]

LikeLike

Did you sign into your Citi account before applying or did you fill out the whole application from scratch?

LikeLike

Did it from scratch.

LikeLike

Just worried since every step seems to imply I’m also opening a checking account if I don’t log in when applying.

Eg wording is like:

“You’re applying for:

Citigold Interest Checking

Savings Plus Account”

However if I log in, it just errors out like Citi’s site always does.

LikeLike

Hmm towards the top left of the page it was pretty clear I was applying for just a savings account. Maybe just try basic?

LikeLike

I opened the savings account several weeks after the checking. I had to fax my SS card and drivers license before being allowed to fund using the credit card. I used a BOA Travel Rewards card to fund over the phone (the same card used for the checking which generated no cash advance or transaction fee), but the charge was supposedly declined. I had to call about the transaction again since I didn’t see the amount (far, far less the amount you funded) on either the BOA credit card or in the Citibank account. Citibank tried a second time and the charge has now gone through.

LikeLike

Strange that it failed to go through the first time but at least it worked the second time.

LikeLike

Anyone recently successfully fund either a Citi savings OR checking account with a Citi AA Platinum personal card? Citi AA Platinum Business card?

LikeLike

Yes. About to open the savings account and repeat.

LikeLike

Anyone have failure or success to report funding Citi savings or checking accounts with Citi AA Platinum M/C, personal version? Citi AA Platinum M/C, business version? Thanks.

LikeLike

Wow – This is an excellent Post!!!!!!!!!!

I had the idea to do this after I opened my checking account with the Credit card & clearing out the balance on the card. When I opened the savings account a few weeks ago I did not see the form to print out so I figured it was a no go.

Then I read this & just called the new accounts & they will be processing the $27,000 on my Arrival card!

I called Barclays Arrival to pre-clear so hope all goes well.

Luckily I never funded it.

Thanks for the tip & $540 in travel 🙂

LikeLike

Excellent!

LikeLike

[…] So, let me describe my experience so far. Keep in mind, I haven’t actually gotten the bonus yet. So, when you head on over to the referenced DoC post, there will be a link to apply. Make sure you put in the code for the offer you choose and select “CitiGold” option (very important). Follow all the steps but don’t fund the account right away because it will probably give you an error (just leave it at zero for now). You do have an option of funding with a credit card but I didn’t do it. Read this post on PointCentric for his experience on using Barclaycard Arrival Plus. […]

LikeLike