I have some good news to share in regards to the 30,000 American Airlines miles promotion that Citibank offered earlier this year for opening a Citigold account. As I’ve mentioned previously, my plan was to wait until the 30,000 AA miles posted and then immediately downgrade my account to a Basic checking account to avoid any fees. In order to waive the $30 monthly fee for a Citigold account, you need to hold $50,000 in the account and that wasn’t an option for me.

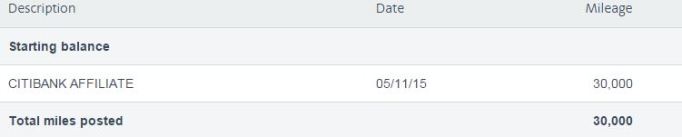

The first bit of good news is my 30,000 miles have finally posted to my AA account on 5/14 (though they were backdated to 5/11 as I have been checking daily). I funded the account on 2/11 so it took a little over 3 months for the miles to post.

Since my goal was to get the miles as quickly as possible (again to avoid any fees), I completed the requirements which were $750 in debit card purchases and two months of bill pay pretty quickly. To do this, I loaded $750 to my RedBird card at Target (you can still do this with RedBird) and paid my wife’s car loan for two months. Below is my whole account activity for the 3 months the account has been open. As you can see, I did the bare minimum to meet the requirement for the bonus and I never was charged a monthly service fee. Citibank does automatically waive the fee for the first two months but I have no idea why I wasn’t charged for April.

The other good bit of news I have to share is that I was able to easily downgrade my account to a Basic checking account just days after my miles posted. In fact, I was able to do it in 7 minutes over secure chat with Citibank! I’ve copied my whole conservation (except for the 3 long statements the rep sent me) to show you just how easy it was.

My account is now a Basic account and as long as I keep $1,500 in the account, I will not be charged any monthly fees. Interestingly when I called in with a question on my Prestige card, I was still recognized as a Citigold account holder (which is expected for now per the rep’s comments). From what others have said, reps still see the account as a Citigold account even after this transition period lapses and I hope this remains the case. I’m curious to see what will happen next year when my Prestige is due for renewal as I would love the $100 discount on the annual fee again for being a Citigold account holder.

I’m very happy I took advantage of this deal as for just the tiniest bit of work I was able to score 30,000 AA miles plus another 2,000 Barclay Arrival points for funding this account with a credit card when I opened it. All of this came without any out of pocket costs so these were truly free miles. I plan on taking advantage of the 30k AA offer for my wife when she gets her next AA card (per Doctor of Credit both the 30k AA and 40k TYP offers are currently available so I could go for the 40k TYP now but I’d rather have the AA miles) and I will be much more aggressive in funding the account with a credit card (i.e more than just $1,000).

Have others seen their miles post and downgrade their account successfully?

Why does your wife needs to wait for her next AA card?

LikeLike

I want the 30k AA offer and that you need an AA card for. Technically anyone has been able to register but in case I have issues, I can point to her having an AA card which should make her eligible. If I wanted the 40k TYP, I could do that now

LikeLike

Can you make her an authorized user of your AA card, and then she can open a new citigold account? I am in the same position as you…

LikeLike

Hmm didn’t think of that. Honestly not sure. I could see it working but my concern is if the miles don’t post for her and I have to have them look into it, they will see its my account and not hers and as such, not award the miles. Maybe I’m being too conservative with this?

LikeLike

This is great–waiting for mine to post as well. It’s been about 2 months.

If I close my citigold (not downgrade) after the miles post, any instances of them clawing back? Or is there language requiring one to keep a citi checking in order to keep the miles?

Thanks!

LikeLike

I’m not 100% sure but I think you would be fine. I haven’t read any reports of miles being clawed back in this case.

LikeLike

I just called citi about this offer and was told that although you are not charged for the first 60 days monthly fees, you are in fact required to keep the account open for at least 5 months (the first 60 days and then three additional months when fees are not waived) , so I am a bit surprised that miles are being posted within @three months rather than five to six… What I heard from citi is enough to warn me off this deal . Comments?

LikeLike

I understand what you are saying but there is nothing in the terms that REQUIRES the account to be open 5 months. Rather I read it as you may have to wait 90 days after qualifying activity (which takes you to the 5 month mark) but they could post it earlier. I think I am good in this case but I would have expected to wait 5 months total to get the bonus – I was surprised as well to get it earlier

LikeLike

[…] Earning the full 30,000 American mile bonus for a Citi checking account without fees or meeting a mi…. […]

LikeLike

When funding the account with a credit card, is it treated as a cash advance? Do you still earn points/rewards for using a credit card in this way?

LikeLike

Not on the Barclay Arrival. See this post – https://pointscentric.com/2015/02/17/update-on-citibank-citigold-30k-american-airlines-offer-funding-my-account-with-a-credit-card/

LikeLike

Subscribe

LikeLike

Doesn’t citi tax mileage bonuses for checking account?

LikeLike

caveat emptor. i once got i think it was 20,000 AA points for opening a citibank account i think around three years ago. in january of the next year, i got a notice that was also sent to the IRA that I was paid a dividend of $650, which is what they (over) valued the miles at. in short, that $650 was reported as taxable income. i suspect that citibank hasn’t changed in sending out the taxable income form for the points earned. this financially aids citibank because the $650.00 is taken off of their books as an expense and put on my books as revenue.

LikeLike

To my knowledge, Citi doesn’t send a 1099 for AA miles anymore. I think Doctor of Credit had a post on it but can’t find it at the moment

LikeLike

I got a 1099 Misc from Citi for earning more than 60k in TYP and using it last year from checking accounts. You won’t get it if the points are earn from CC (I got more than 300k AA mles from CC) but since it was from checking accounts, they sent the 1099 MISC.Not sure how they would value AA miles earned through the banking side though.

LikeLike

I don’t think they send 1099s when you earn AA miles so this might be another reason to chose an AA checking offer over a TYP offer

LikeLike

make that the IRS

LikeLike

Is this offer churnable? I got the 30K miles about two years ago then downgraded to basic checking but the downgraded checking account is still open.

LikeLike

The offer states for new account holders only so I would guess no in your case. What might work is if someone closed their account and then sometime later (possibly years) opened a new account. I have no insight if that will work but based on how loosely Citi enforces limits on credit card, it very well might.

LikeLike

Any negatives to closing a checking account and reopening? Is the age of your checking account important in any way? When I call Citi they always thank me for having an account for over 18 years with them.

LikeLike

I don’t think there is. Outside of being able to leverage that during a reconsideration call for a credit card where you can point to being a loyal customer for 18 years, I don’t there is much benefit.

LikeLike

Did the charge on your Barclays card show as a cash advance or purchase?

LikeLike

Purchase and I set my cash advance limit to zero beforehand. See this post – https://pointscentric.com/2015/02/17/update-on-citibank-citigold-30k-american-airlines-offer-funding-my-account-with-a-credit-card/

LikeLike

hhttp://www.creditcards.com/credit-card-news/irs-taxable-income-credit-card-rewards-points-gift-1277.php

LikeLike

hu

LikeLike

I never got my bonus. Every time I asked, the rep asked me to produce the email listing the promotional code. Obviously I didn’t have it because I got the code off the internet. So that was a waste of my time.

LikeLike

Sorry to hear it didn’t work for you. I know others have had success without getting the code directly – not sure why it didn’t work for you.

LikeLike

Awesome news Ralph! I opened an account for myself in February and then my wife in March after I realized how easy this was, but hadn’t yet seen any fees to either account. Our AA miles haven’t posted yet, but I didn’t know this would be a great way to MS too. I opened each account with $18,000 from my Arrival+ and can also report no cash advance fees (set limit to zero first). So, around $800 in travel from my Barclays card before we even get to the 60,000 AA miles which hopefully post soon! Thanks for the update!

LikeLike

Hi Ralph, I am looking at the citi bank online credit/deposit form (which I have to mail to citibank) but in nowhere does it indicate my checking account number. How does citi know which checking account to fund my deposit? Thanks! This is the form citi asked me to fill out:

Click to access CreditCard.pdf

LikeLike

I opened my account yesterday over the phone (Citigold office 1-888-248-4465). I gave them the code 4Y6KEW8XL3 — he found the offer and read all the terms to me. I was approved, and I funded it with $2,000 from a Citi Aadvantage credit card and was told I would receive a letter explaining terms which I would have to sign and send back; only at that time would my account be funded. It sounds as if it will be almost 2 weeks before the account will be available to satisfying terms — a different experience than I have read about here, but I don’t mind because it will give me time to figure out how I will work this deal. I’m thinking about transferring some retirement funds to fulfill my required minimum to avoid the fees. It can all be linked.

LikeLike

You were able to use a CITI AA card to fund your CITI Gold Checking Account?? Did you pay cash advance fees?? Explain how things worked for you please. Thanks

LikeLike

Can I fund my bluebird account and count it to fulfill the $750 requirement?

LikeLike

It should

LikeLike

Thanks for this post! After setting up the CitiGold account on 7/2/15 and completing the requirements in August, the 30K AA points finally posted today 12/9/15 (but show 12/7/15). I was charged 2 fees which I asked for and was given credit on. Tried the chat to have the Gold downgraded to basic, but chat had me call in which was no problem at all. Thanks again for the datapoints! Love reading this blog.

LikeLike

Glad this worked for you!

LikeLike

What did you say when you asked for the fee credit, and did you call, chat or send a SM?

LikeLike

I called in asking about the miles not posting so they opened up an investigation. I mentioned that since this is taking longer than normal can I get a credit on the monthly fee, to which they happily obliged. I did this twice and they were very nice about it both times.

LikeLike

Thanks, that is a good idea.

LikeLike